Humor is a commonly used technique in video advertising. In fact, some advertisers use humor in nearly all the commercials they run. Humor allows agencies to be creative and viewers enjoy being entertained. But of course, the purpose of a video ad is to promote the featured brand. Advertising legend David Ogilvy cautioned against the use of creative content, such as humor, which did not further this goal:

If it doesn’t sell, it isn’t creative.

– David Ogilvy

At the same time, there is clearly a role for humor in effective advertising, as the general disdain for the medium can be softened through this type of entertaining device:

Fun without sell gets nowhere, but sell without fun tends to become obnoxious.

– Leo Burnett

Over the years, MSW Research has investigated the use of humor in advertising to see how successful brands and agencies have been at producing humorous advertising that is also sales effective. The verdict from these studies is that, despite its common usage, there is no guarantee that it works and no consistent benefit from the use of humor in advertising.

- For decades, MSW has judged video ads submitted to our copy testing system on an array of advertising content elements. One of these elements is “humorous tone”. Across thousands of video advertising tests, there has been no consistent effect of the presence of a humorous tone on the sales effectiveness of the advertising (as measured by the MSW CCPersuasion metric).

- MSW has also examined the relationship between the percent of test respondents indicating an ad was “entertaining” or “fun to watch” and the ad’s MSW CCPersuasion score from copy testing. Across four independent data sets, there was consistently found to be no significant relationship between these metrics (which would commonly be driven by humorous content) and an ad’s sales effectiveness.

Since humor, in and of itself, does not seem to help or hurt video advertising effectiveness, on average, MSW conducted a study to examine different uses of humor to see if there are some approaches to using humor that are more effective than others.

First, a selection of ads with a humorous tone were viewed and four common uses of humor were identified:

- to poke fun at or show superiority versus a competitor

- to demonstrate the need for the product

- to illustrate how good the advertised product is or emphasize an important feature of the advertised product

- not related to product performance or need

Next, a set of approximately 200 video ads with a humorous tone were randomly selected from among all the humorous ads in MSW Research’s copy-testing analytical database. Each ad was viewed and most (N=165) were judged to fit into one of the above “use of humor” classifications.

To compare the strength of the ads within each humor classification, each ad’s CCPersuasion score was statistically compared to the Fair Share benchmark so that it could be classified as:

- Superior (statistically above benchmark),

- Average (equal to OR no significant difference relative to benchmark), or

- Below Average (statistically below benchmark)

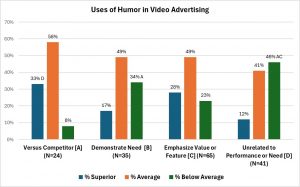

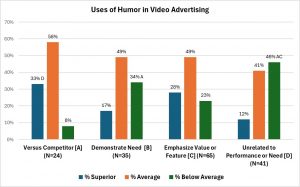

Then for the set of ads within each of the humor classifications, the distribution of CCPersuasion scores relative to the Fair Share benchmark was determined. The following chart shows that the effectiveness of the ads within each humor classification appears to differ substantially between the different classifications.

- The percent superior is around 30% for both “Versus Competitor” and “Emphasize Value or Feature” while it is about half that (17%) for “Demonstrate Need” and only slightly above 10% for “Unrelated to Performance or Need”.

- “Versus Competitor” has by far the lowest percentage of below average ads, while nearly half of those with humor “Unrelated to Performance or Need” are below average.

Statistical testing supports these observations, despite relatively low base sizes. Overall, there is a statistically significant difference among the four distributions, suggesting that different uses of humor do tend to result in different MSW CCPersuasion results versus Fair Share. In particular, the results for “Versus Competitor” and “Emphasize Value of Feature” are statistically better than those for “Unrelated to Performance of Need”. In addition, the high Below Average rate for “Demonstrate Need” suggests this approach is less likely to lead to success particularly relative to the “Versus Competitor” approach.

These results suggest that there are some uses of humor that appear to be more likely to lead to strong advertising. The following are some examples of each of these approaches to using humor, ordered from most to least likely to results in superior advertising.

Uses humor to poke fun at or show superiority versus a competitor

In its classic Mac vs PC campaign, Apple used 66 video spots between 2006 and 2009. This campaign used humorous personification to contrast the Mac (cool and hip) and the PC (stodgy and bumbling). In the following example video, the humor is used to extend the comparison between the two devices to the dimension of set up and ease of use (“it sounds like you have a lot of stuff to do before you do any stuff”).

In a more recent example, the Allstate “Mayhem” campaign uses an indirect comparison to competitors, humorously illustrating the types of damage that Allstate would cover, but not necessarily “cut-rate car insurance.”

Use humor to illustrate how good the advertised product is or emphasize an important feature of the advertised product

The following 2024 Super Bowl ad for Doritos Dinamita uses humor to show how good the product is by depicting the lengths the two grandmas would go to in order to get their hands on the last bag.

This spot for Seventh Generation baby products featuring Maya Rudolph uses humor to emphasize that Seventh Generation doesn’t include artificial fragrances such as the common “baby smell” that most baby products have.

Uses humor to demonstrate the need for the product

The following video ad for Lactaid uses humor to demonstrate the effects of milk on people with lactose intolerance, setting up the need for the advertised product.

Uses humor that is not related to product performance or need

In the following Super Bowl ad for State Farm, the spot derives its humor from Arnold Schwarzenegger’s inability to say “neighbor” but instead he says “neighbah”. While the word “neighbor” is derived from State Farm’s famous tagline, the humor itself is not directly related to the company’s performance or the consumer’s need for their services.

While following these guidelines can help increase the likelihood of producing an effective humorous video ad, the only way to know for sure is through testing. MSW’s CCPersuasion measure is the most validated measure of video ad sales effectiveness. Contact us for more information.